Key takeaways you will find in this article

- •Fixed asset reports provide detailed insights into asset value, location, and maintenance history for better asset management

- •Different types of fixed asset reports, such as depreciation and inventory reports, support compliance and financial planning

- •Developing effective fixed asset reports requires accurate data collection, regular updates, and cross-departmental collaboration

- •Fixed asset management software simplifies report creation, improves asset tracking, and enhances organizational efficiency

Table of contents

Tracking and managing fixed assets is essential. Organizations across the public and private sectors aim to maximize asset performance and ensure financial reporting compliance.

Fixed asset reports are critical in accomplishing this. With fixed asset reports, organizations monitor asset value, track depreciation, and plan for future capital expenditures.

To understand their holistic benefits, we’ll unpack the basics of fixed asset reports, how to create them, their benefits, and provide a sample. But first, we need to define how we use assets in this context.

What are fixed assets?

Fixed assets are an organization’s long-term physical property. Assets include buildings, machinery, and equipment. These items are not quickly converted into cash. That distinction separates assets from inventory.

Assets provide value over time. To maximize ROI, organizations must accurately track them. This will optimize their lifespan and performance.

What are fixed asset reports?

A fixed asset report details each asset’s value, location, maintenance history, and depreciation. These documents are similar to asset inventories. However, they focus specifically on fixed, long-term assets.

This granularity is essential for financial reporting and fixed asset management. It also provides deeper insights into asset lifecycle performance and financial impact. Fixed asset reports include:

Asset name and location

This title should distinguish the asset from its peers. By giving the asset name and location, readers should be able to easily find an asset in a facility.

Current value and initial cost

This section should detail the asset’s current value and include its initial cost. Accountants use the original cost to determine net book value. It’s calculated by subtracting accumulated depreciation from the original cost.

Depreciation and maintenance history

This section should detail the depreciated value of an asset as well as its maintenance history. Depreciation is the other variable used in the net book value calculation. And an asset’s history is critical for maintenance planning.

Types of fixed asset reports

Not all fixed assets are the same. While all will detail various asset financial reporting standards, they serve different purposes. Here are the most common types:

Inventory reports—Track asset quantities and locations.

Maintenance reports—Record service history to optimize maintenance schedules.

Depreciation reports—Calculate asset depreciation to reflect accurate financial value.

Audit trail reports—Provide a history of asset transactions for accountability.

Disposal reports—Record details of asset disposal, ensuring compliance with disposal regulations.

Reconciliation reports—Match financial records with physical assets.

Capital expenditure reports—Track capital investments for financial planning.

It’s critical to understand when to use each type of report for all of your organization’s current assets. These standard reports will provide accounting information across each asset category.

The fixed asset report process

Creating effective fixed asset reports is essential to financial management processes. These should include detailed information to help cross-functional teams make informed decisions about assets.

The creation process involves a basic structure. Approaching it this way ensures data accuracy and relevance. Here’s a step-by-step guide to developing comprehensive fixed asset reports:

Identify assets

Begin by listing all relevant fixed assets, including buildings, equipment, and machinery. Ensure the list includes all assets that contribute to long-term operational goals and will not be converted to cash within the fiscal year.

Capture, analyze, and discover actionable insights

Understand equipment repair trends, analyze labor cost and time, justify capital improvements, and plan your organization’s budget expenditure.

Collect and record data

Gather essential details for each asset, such as asset name, location, acquisition date, purchase cost, estimated useful life, and current condition. Fixed asset management software can be instrumental in centralizing this information for ongoing accuracy.

Determine depreciation method

Select an appropriate depreciation method (e.g., straight-line, declining balance) based on asset type and usage patterns. Apply this method consistently to track and reflect each asset’s value accurately over time.

Document maintenance and service history

Record each asset’s maintenance schedule, service history, and any repair work performed. This information is crucial for optimizing maintenance planning and ensuring assets operate at peak performance.

Track asset movement and usage

Maintain records of any location or department changes. Tracking asset movement across departments provides transparency and accountability.

Generate and distribute reports

Use asset management software to generate reports that include relevant data points, from asset value and depreciation to maintenance status. Share these reports with relevant departments to ensure decision-makers have access to up-to-date asset insights.

Update reports regularly

Fixed asset reports should be updated periodically to reflect changes such as new acquisitions, disposals, and adjusted values. Quarterly or annual reviews help keep reports aligned with financial records and operational needs.

Review and audit reports

Regular audits verify the accuracy of fixed asset data and highlight discrepancies. Audits help maintain data integrity, support compliance with regulations, and ensure accurate reporting.

How is a fixed asset report used?

Fixed asset reports are critical parts of every organization’s financial management processes. They provide valuable insights that:

- Track asset value and depreciation over time for accurate financial reporting

- Manage asset lifecycles by identifying when assets require maintenance or replacement

- Inform capital planning to ensure investments align with the budget

Benefits of fixed asset reports

Fixed asset reports are a necessary part of an organization’s overall health. They provide numerous benefits like:

Enhanced decision-making

Fixed asset reports equip decision-makers with accurate, up-to-date data, improving planning and investment decisions.

Regulatory compliance

Organizations benefit from compliance with financial regulations, ensuring accuracy in financial statements.

Proactive maintenance

Reports support a preventive maintenance, reducing the likelihood of unexpected repairs and extending asset life.

Risk mitigation and cost reduction

By tracking asset performance and depreciation, companies can identify risks and make adjustments to minimize costs.

Operational efficiency

Detailed asset records streamline preventive maintenance scheduling, reducing downtime, and improving productivity.

Cross-departmental collaboration

Fixed asset reports encourage interdepartmental sharing of data, fostering collaboration among finance, operations, and maintenance teams.

Fixed asset report template

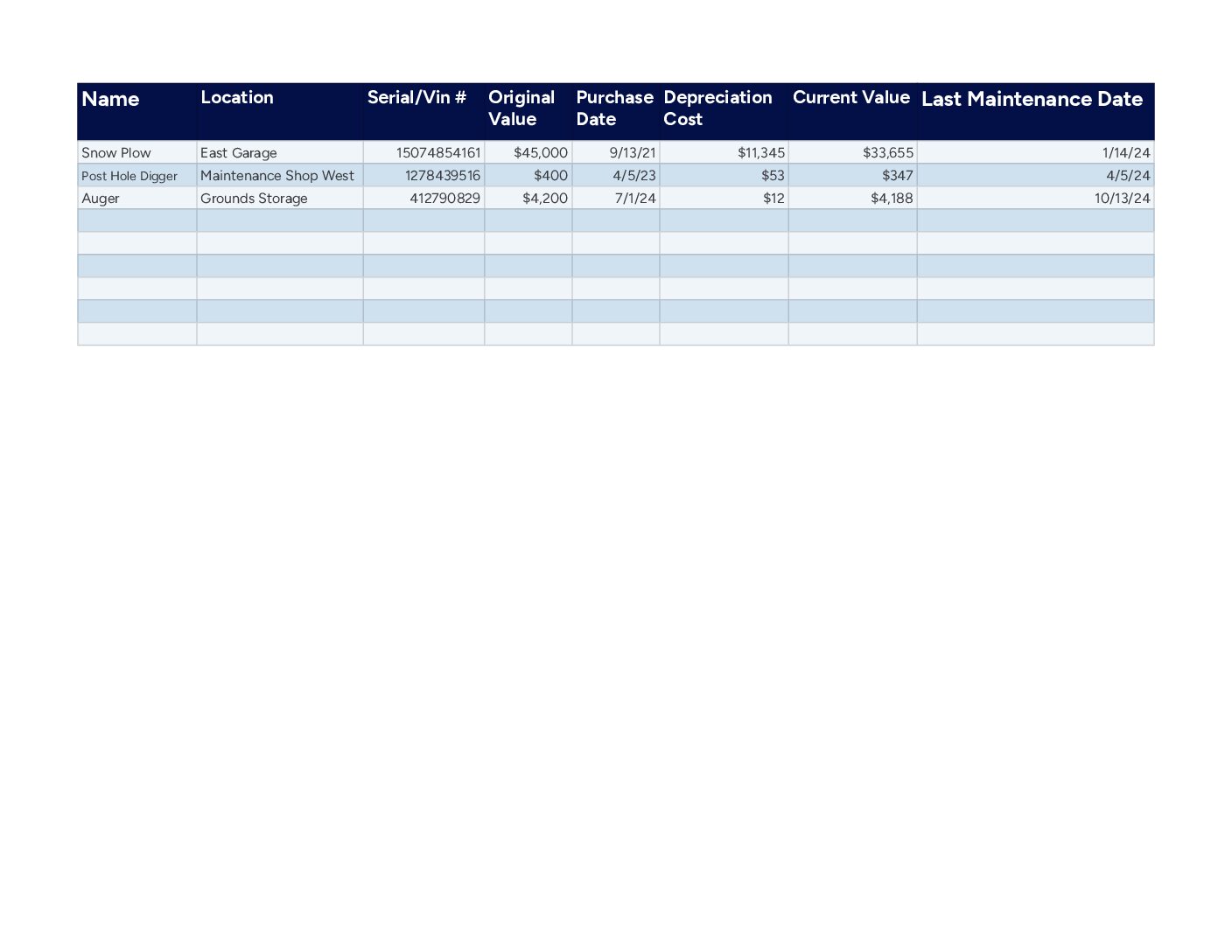

Here is an example fixed asset report. It should include columns for asset name, location, acquisition date, initial cost, current value, and last maintenance date.

How software can help with a fixed asset report

Fixed asset reports are necessary for supporting an asset management strategy. Without fixed asset management software, their creation can be daunting. An effective solution simplifies report generation and management, offering several advantages:

Detailed asset tracking

Asset tracking is a critical underpinning of these financial reports. Fixed asset management software provides centralized, real-time asset data. This repository reduces manual tracking effort and enhances accuracy for better asset management.

Increased collaboration

Cross-departmental collaboration is important for success. With fixed asset management software, data is easily accessible to all departments. This centralized functionality ensures maintenance, finance, and operations teams can coordinate effectively.

Measurable KPIs

The software helps track asset maintenance key performance indicators (KPIs), enabling data-driven decision-making and process optimization.

Optimized maintenance schedules

Asset maintenance is needed. It maximizes the lifecycle of an asset and keeps your investment operating as intended. With fixed asset management software, organizations can automate reminders and tracking. This reduces downtime while keeping assets operational and in peak condition.

Better asset utilization

Return on investment is critical for organizations across the public and private spheres. With fixed asset management software, leaders can leverage insights from asset reports. This leads to improved utilization, maximizing return on investment.

FMX—fixed asset management software

With FMX’s asset management tools, organizations can store all asset details in one place. Users upload images, videos, PDFs, and capture additional information with configurable fields.

Users seamlessly track asset value, schedule maintenance, and improve cross-departmental collaboration.

FMX’s easy-to-use software helps ensure that all fixed asset data is accurate and up-to-date, enhancing your organization’s ability to manage and optimize its assets effectively.

Users gain actionable insights to identify expected asset replacement dates and costs, optimize labor schedules, and plan budgets for the upcoming year.

Want to see what fixed asset management software can do for your organization? Reach out to set up an FMX demo today.

Written by

Zach Jones

Content Manager at FMX