Table of contents

The more information you have about a fixed asset’s useful life, the better you can manage it. Effective fixed asset management allows organizations to plan maintenance and maximize peak performance.

It also allows organizations to amortize fixed asset costs, create service schedules, and plan for future fixed asset investments. To understand how it’s critical to first familiarize yourself with a fixed asset’s useful life. We’ll break down its principles and how it integrates into larger fixed asset management strategies.

What are fixed assets?

Before we detail exactly what a fixed asset’s useful life is, let’s first explain what we mean by assets. Fixed assets are long-term resources that provide an organization benefits over several years. They are broken into categories like real estate, equipment, machinery, and vehicles. Fixed assets are not expected to be converted to cash within a fiscal year and require ongoing management to track their depreciation, maintenance, and eventual disposal.

Because of their longevity, fixed assets are annually recorded on an organization’s balance sheet and not fully expensed at one time.

Examples of fixed assets include:

- Buildings and real estate

- Manufacturing machinery

- Computers and office equipment

- Vehicles used for business operations

Understanding the useful life of a fixed asset

A fixed asset’s useful life is the estimated time it’s expected to be usable. This can vary depending on the asset type and how it’s used. It can also change based on wear and tear, technological obsolescence, the depreciation method, and market conditions.

The fixed asset’s useful life is used to determine how long until the asset will be fully depreciated for accounting purposes. It’s important to know the useful life of your facility’s assets because this information is used to calculate equipment depreciation.

Depreciation is an accounting technique utilized to spread the expense of an asset over its period of usability to help make better financial and management decisions. It can also enhance your facility’s asset replacement or disposal plans. This will help avoid disruptions and ensure continued smooth business operations.

Asset depreciation vs. fixed asset useful life

While sometimes used as related terms, asset depreciation and the useful life of an asset aren’t the same. Here’s how they differ:

Fixed asset depreciation

Depreciation is an accounting method that calculates an asset’s value loss over time due to wear and tear, obsolescence, salvage value, or other factors. It’s part of the financial reporting an organization must complete annually. There are several methods for calculating depreciation like straight-line, declining balance, and production-based.

Fixed asset useful life

In contrast, the useful life of an asset is the time it’s expected to remain in service.

While the useful life of an asset is used to determine the amount of time over which the tangible asset will depreciate, it’s not the same as the depreciation itself. Depreciation is actually recorded as an expense on the company’s financial statements, while the useful life of an asset is only a planning tool.

Calculating the value of useful life

Calculating the value of useful life

Fixed assets take a physical form and are owned by a business or organization. For tax purposes, the IRS has provided a predetermined period of time for most standard office/business equipment depending on its use.

Computers, office machines, and similar assets, for example, are generally given useful life estimates of five years. Large pieces of equipment, or a capital asset, could have a five- or ten-year estimated useful life depending on their purpose.

| Asset class | Type of assets |

|---|---|

| 3-year property | Tractors and qualified rent-to-own property |

| 5-year property | Vehicles, computer equipment, and research equipment |

| 7-year property | Office furniture and fixtures and farm equipment |

| 10-year property | Boats and single-purpose farm structures |

| 15-year property | Land improvements (landscaping, roads, and bridges) |

| 20-year property | Multiple-purpose structures |

If you intend on using the depreciation amount from the useful life of an asset solely for equipment maintenance planning, the above standards might not accurately depict how long If you use the depreciation amount from the useful life of an asset solely for equipment maintenance planning, these standards might not accurately depict how long you will actually benefit from your equipment. As mentioned above, other variables, such as technological advancements and environmental changes, factor in.

What about the useful life of intangible assets?

Like physical equipment, intangible assets have a finite lifespan. Trademarks, copyright, and intellectual property are all intangible and will eventually lose their value. You can calculate the useful life of an intangible asset by determining the amount of time it’s expected to provide economic benefit to the company. Trademarks, for example, generally expire after five years and need to be continually renewed to remain at book value on a company’s financial statement.

How to calculate the useful life of a fixed asset

The useful life of an asset can be calculated by taking a number of different factors into account. The easy route is to use the standards provided by the IRS. You can also:

- Refer to the manufacturer’s specifications. These are laid out in the operating manual. You may be able to find data representing the number of uses or hours the equipment is expected to function. This information can then be compared with your frequency of use to determine a likely life expectancy.

- Maintain strong asset tracking records. If the last photocopier lasted three years before failing, it’s probable that the same model purchased again under the same usage will provide similar results. Using calculations like the mean time to failure (MTTF) or mean time between failures (MTBF), which averages out the failure time, can be worthwhile.

- Keep tabs on the asset’s life cycle. If it tends to break down or require replacement parts more quickly, the equipment’s asset lifecycle likely won’t last an extended period without a replacement.

- Consider the possible impact of economic changes. A boiler kept in a school’s basement will be less affected by obsolescence than a smartphone, which has a higher risk due to the rapid change in technological advancement and consumer demand. Other assets, like machinery and vehicles, may become obsolete due to changes in regulations and industry standards.

Regardless of the method used, it’s important to keep in mind that the total number of years is an estimate and might not be accurate. It’s a good idea to regularly review the useful life of your assets to ensure it remains true-to-life and up-to-date.

Fixed asset useful life table

A fixed asset useful life table is an effective tool to maintain records. This resource lists all of an organization’s estimated useful life calculations for each asset. Here is an example of one you can download:

Extending the life of your fixed assets

Extending the life of your assets is a great way to get the most value out of your business. Other than ensuring you schedule preventive maintenance and repairs, there are a few ways you can get the longest remaining useful life out of your equipment.

To extend the life of your assets, try the following:

- Regularly assess your assets

- Keep your assets up-to-date with new technology

- Utilize remote monitoring and maintenance services that can detect when a failure is imminent

- Replace faulty or poorly performing parts to increase the residual value (the re-selling price)

- Use a robust asset management system

- Optimize your assets for sustainability

Optimizing fixed assets for sustainability

Going “greener” and making decisions based on the organization’s effect on the environment is important for staying true to environmental, social, and governance (ESG) standards. Additionally, it helps institutions extend the life of their assets. For example, scheduling lighting or heating automatically upon building entry can greatly reduce energy consumption. As a result, the stress on the equipment would also be reduced. This gives assets a higher likelihood of lasting a longer period of time.

Other ways you can extend the life of your assets through sustainability include:

- Reducing the number of trips maintenance teams make by completing tasks remotely

- Solving small equipment issues quickly before they become larger, energy-consuming problems

- Using AI and machine learning techniques for inspections and auditing methods to better understand the state of equipment and to identify potential issues

Equipment maintenance software, integrated with your building’s automation system, helps to keep track of assets and monitor their lifecycle.

How can fixed asset management software help?

Asset maintenance can be time-consuming and costly. For a facility’s balance sheet, your organization will likely need an estimated equipment life to calculate your depreciation expenses. It’ll likely fall to you to deliver the best, most up-to-date representation of your organization’s assets. Without an entire team on your roster, it can be a challenge to keep track of your assets and their current status.

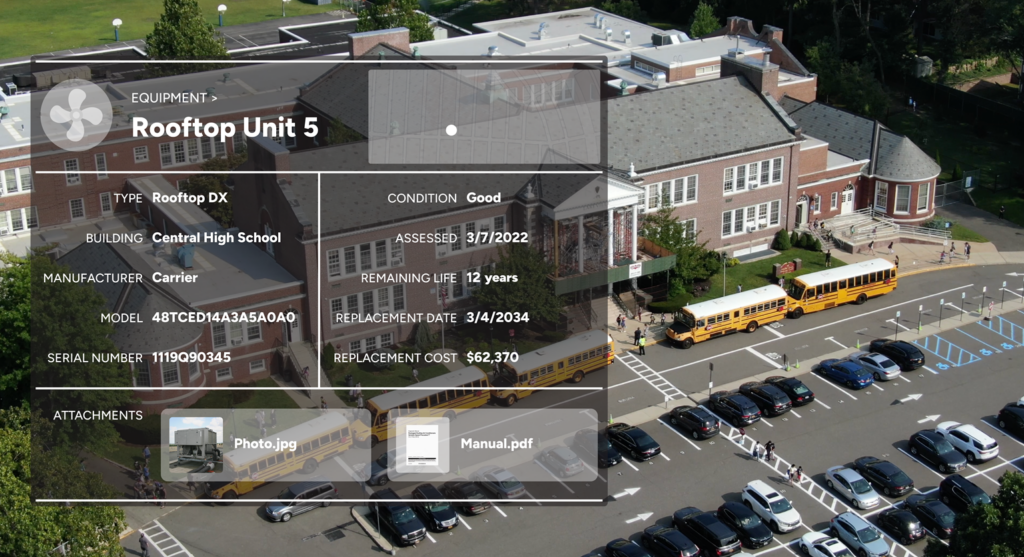

FMX’s fixed asset management software can help by providing a system that’s more efficient and cost-effective than manual asset tracking. It can also help prevent costly breakdowns and failures by scheduling preventive tasks and maintenance.

FMX can help ensure that assets are used to their fullest potential. See how. Set up a demo today.

Written by

Dana Grove

Manager, Brand and Content at FMX